The pandemic has affected individuals, businesses, communities and economies globally. New trends are catching up, some fleeting and some that will be deeply engrained into the system for the years to come.

As several industry sectors open up to the economy, massive changes are afloat. From consumer buying behavior to government response, there seems to be a new order of things building around us. The Indian Mortgage, Banking and Credit industry will be no exception and is bound to redefine itself in response to the Covid-19 virus.

The growth of the credit industry in the last decade

In the last few years, the credit economy in India grew at an unprecedented rate.

New loan origination in 2019 was 30% more than it was in 2018. Unsecured lending (personal loans, housing loans and finance and consumer durable good loans) contributed the most to the volume increase. The credit card market also expanded and grew into the rural and semi-urban part of the country. Fintech companies and digital lenders proliferated the market with highly specialized loan products and thus appealed significantly to the younger consumers (millennials).

When the entire industry was looking into a future of higher loan growth and financial technology revolution, the pandemic struck and things began to slow down.

What trends are likely define the traditional and digital loan systems of the country in the future?

Will banks and private lenders continue to grow at the same rate? What technology trends will continue to assist the growth of credit industry in India?

Read on to find out how economic, technological and people factors will influence the credit industry in the long and short term.

1. Cautious spending and unemployment will hinder the growth of the retail loans

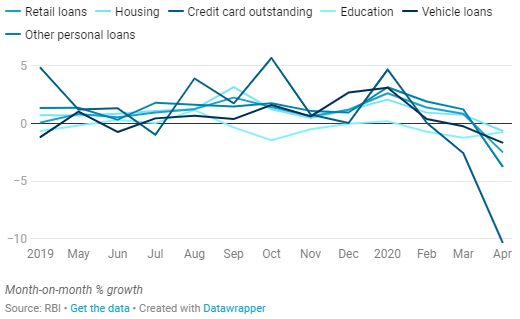

Retail loan disbursements have seen a sharp fall in the last few months. Most categories, including, personal loans, housing loans, vehicle loans and credit card debts have shrunk when compared to the start of the year. This, however, does not come as a surprise, considering the fact that the lockdown has pushed Indians to spend only on essentials and curbed their chance to make investments in any form.

Slow retail loan growth is expected to continue into the months of the third quarter too as the national unemployment rate has shot up and the fear of the pandemic is yet to subside.

Experts believe that spurts of discretionary spending may be observed as lockdowns ease but this does not guarantee a swift growth in retail loans until early next year. In other words, the pandemic has created a major hiatus on the growth rate of the retail loan sector, which has been the greatest source of expanding loan books since 2016.

A graphical representation of loan growth trends in the last fiscal year

Source: Reserve Bank of India (RBI)

2. Loan defaulters will be on the rise

As recommended by the RBI, financial institutions have offered loan term relaxation to facilitate business continuity (moratorium extension until August 31st). However, lack of income due to lay-offs and pay cuts will allow a higher rate of delinquent loans in the upcoming months.

You May Also Like: Why Should You Use A Cloud-Based Loan Management Software?

3. Using technology for smoother operations

Cash flow problems among consumers will push NBFCs and other private lenders to reconsider their underwriting processes and the methodologies used to assess the creditworthiness of potential as well as existing customers. Technologies such as AI (artificial intelligence), big data analytics and machine learning should be adopted by lenders to ensure fair and yet stricter assessment of creditworthiness of borrowers. In fact, experts from Frost & Sullivan have predicted that the use of AI in loan management will increase by 31% annually and since automated systems cost almost 50-90% lesser than employees, the growth rate is expected to reach a whopping figure by 2022.

4. Technological solutions will be deployed in loan collection and disbursement processes too

Banks and financial institutions have seen a clear towards digital since the lockdown commenced.

Increased use of digital payment methods (the first 21-day lockdown period alone witnessed 42% hike in digital payments) and online lending have been observed. However, moving into the digital space also, calls for increased security measures and redefined operational methods. Technological such as the use of automation tools and advanced technologies like robotics can be deployed in loan collection and disbursement processes to fill the gaps.

5. Increased investments in loan management systems

2020 may not be an easy business year for lenders. Diversifying the product portfolio and focusing on value-added services as additional benefits may be some ways of retaining customers and procuring new ones. By investing in a good loan management system that facilitates seamless workflow, enables quicker decision making and customer-focused services, lenders can focus better on their core business competencies. The complexity in business operations that results from increased product offerings and changing industry regulations can be better handled with the help of loan management systems.

6. Micro-credits will be on the increase

As revealed by a study from the University College London, low-income groups n developing countries are the worst affected by the pandemic. In India, these groups are also the least likely to gain access to traditional credit (as they may not fulfill the eligibility requirements). Digital lenders will emerge as their savior and microfinance lenders will satiate the credit needs of these groups. Affordable repayment solutions and leveraging of digital technologies for timely loan disbursements and contact lending will be the biggest push factors of the systems.

7. Data analytics will take the front seat in redefining the underwriting process

Data analytics already holds a pivotal position in the lending industry. Going forward, data scientists will be using additional data to redefine the underwriting methodologies of financial institutions, especially in the case of small-ticket loans. Data will be mined by tracing digital footprints, customer-profiling, mobile data scraping and geo-tagging and will be used in risk mitigation for the lender.

8. Emergence of new lending players and more specific products

As the lockdown eases out, and small and medium-sized businesses are getting back on their feet, lack of working capital will be a major problem. While traditional banks with high liquidity and lenders who are well aware of MSME lifecycles will be able to help the business, emerging lending platforms and platforms offering alternative funding options are needed to fill the gap.

The emerging lenders will focus on building sector-specific products with convenient repayment facilities for the long, medium and short tenures. New players in the sector must hold significant information about the sector they wish to cater to and take the aid of technology in order to be successful and risk-free. Meanwhile, support in the form of regulatory intervention to such institutions can help in reviving the MSME sector.

9. Surge in gold loan volumes

In the last few weeks, banks and NBFCs have witnessed a significant jump in the demand for gold loan. It is estimated that banks are currently holding about 2.35 lakh crore worth of the yellow metal in secured loans. Small business owners and individuals with cash liquidity challenges are increasingly availing gold loans across the country. Since the price of gold has increased radically in just one year, consumers are taking advantage of its high value through loans.

10. Fintech start-ups will emerge in the lending sector

In the first quarter of 2020, India has attracted over USD 330 million through venture capitalists in fintech funding, thus surpassing China, which was considered as the breeding ground for VCs. Start-ups in the lending and payment sectors grabbed the largest chunk of the investment. Since China, the place believed to have given the Covid-19 virus to the world, has been hardly hit, India with a higher potential for fintech growth is expected to make room for more digital lenders.

You May Also Like: Lending Trends to Watch in 2020

11. Lowered appetite for risk among lenders

As mentioned earlier, more care and effort will go into assessing creditworthiness of customers, as lenders tend to be more proactive in avoiding risk at this crucial time. Another important factor that reconfirms the risk mitigation trend among lenders is the rejection of loans for candidates who have availed the government-endorsed moratorium (the RBI has extended the moratorium of EMI loans until August 31st, 2020). In fact, many banks have rejected loans that have already been approved but have not been disbursed to the borrower. While the government declared that availing the moratorium will not have any negative impact on the credit score of an individual, banks believe that sanctioning additional loans to borrowers with a cash crunch is riskier. To counter this, some industry experts stress that availing of moratorium is not necessarily due to current cash crunch but a way of preserving money for the uncertain economy.

12. Increased use of financial-grade APIs

As we are increasingly banking on technology to build robust models for the lending business, higher is the need to mitigate cyber security risks, and APIs are a way to achieve them (apart from AI-enabled KYC platforms, specialized firewalls and other authentication methods). APIs automate data collection and validation and enhance the quality and quantity of customer data in hand. The consumer credit data driven by APIs, make lending decisions quicker and more accurate. The RBI has already established the initiative to digitize the KYC process and with the social distancing norms in place, the use video KYC solutions that are RBI regulatory-compliant will be on the rise.

13. Banks to include co-lending as an important area of focus post-COVID

Co-lending is an arrangement in which NBFCs facilitate the loan origination and collection process while the partnering bank houses the majority of the loan (generally 80% or above). This model of lending is expected to gain impetus as it benefits all stakeholders and resolves the fund-based growth problem of NBFCs. For instance, the country’s largest bank, State Bank of India (SBI) has already partnered with multiple traditional and digital NBFCs for co-lending arrangements and has in fact taken things a notch up by digitizing the flow of loan leads from NBFCs to directly come to the bank with no human intervention. Mid-cap NFBCs such as IIFL, Capital Float and Paisalo Digital are among the ones that have already taken the plunge.

14. Stricter regulations for banks and NBFCs partnering with digital lending platforms

Banks and NBFCs are strengthening their partnerships with digital lending platforms and other fintech companies to be prepared for the rebound of the pandemic. A detailed account about how various technologies and Fintechs are redefining the business for NBFCs can be learnt here.

Since cases of cyber-bullying and fake notices to borrowers were reported during the initial days of the lockdown, the RBI has intervened to curb such malpractices. Going forward, banks and NBFCs as well as the digital lending platforms will be required to report details of their partnerships with other entities, in advance. Confirmation of the same must be administered in written form before sanctioning of the loan.

Also, banks and NBFCs, irrespective of the platforms used, hold more accountability for loans. In other words, banks and their digital partners will together practice more transparency of operations and make joint efforts to establish the grievance redress mechanism. Violation of any of these rules by banks or NBFCs will be reviewed seriously by the RBI.

15. Small-ticket loans will be more prevalent

As cash liquidity continues to haunt businesses and households, small ticket loans or micro loans will be gaining momentum. These small tickets loans are similar to the FMCG products that are packaged as “Five rupee sachets” (hence these loans are also called sachet loans) that are used for market penetration. Since commoditization of loans have lowered adoption, small-ticket loans with shorter tenure and lower interest rates can be a solution.

Final words

Lending institutions across the country will be facing a slowdown in business but the lending industry will play a significant role in economic recovery. Digital transformation and brand purpose will take center stage. Digital tools and techniques will be aimed at achieving refined operations, mitigated risks and customer loyalty. Brand purpose on the other hand will push companies to discover the real purpose behind their existence and look for ways to connect deeper into the lives of customers. Clearly, strategic assessment and planning are required to handle the long-term, paradigm shifts brought upon us by the virus.