Product Creation

It defines the product you’re going to offer for your customers such as Personal Loan, Business Loan, Vehicle Loan, etc.,

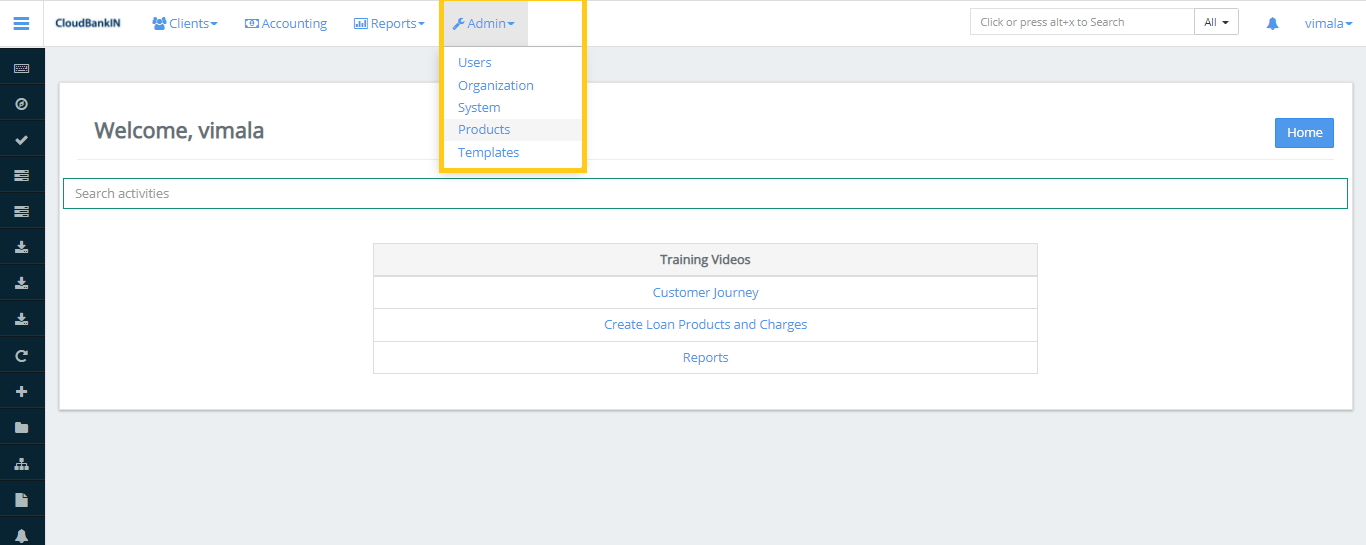

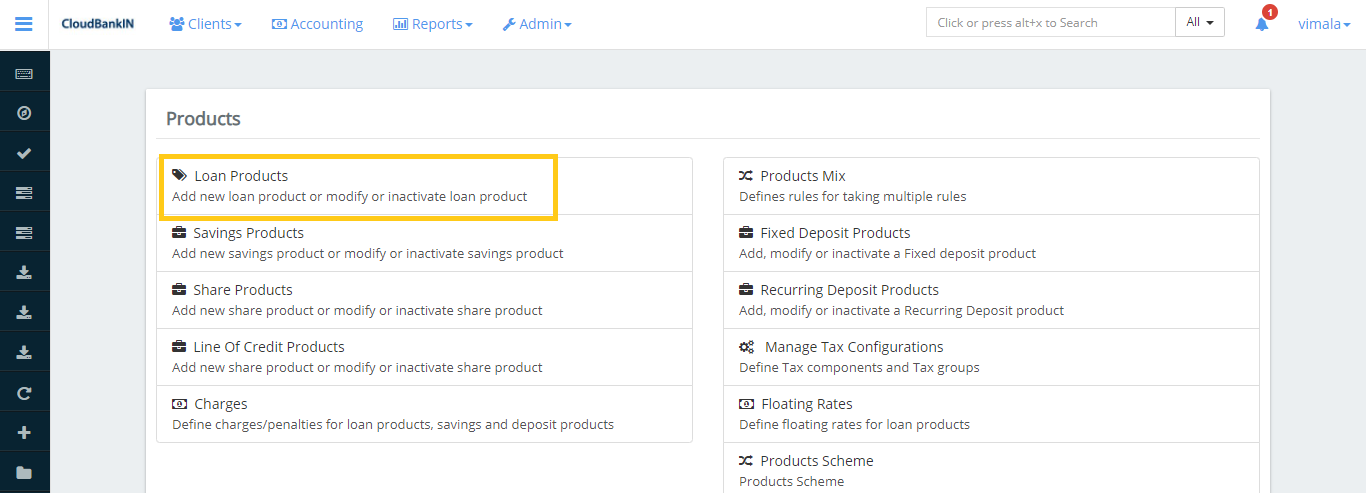

Go to Admin and select the Products and click on Loan Products.

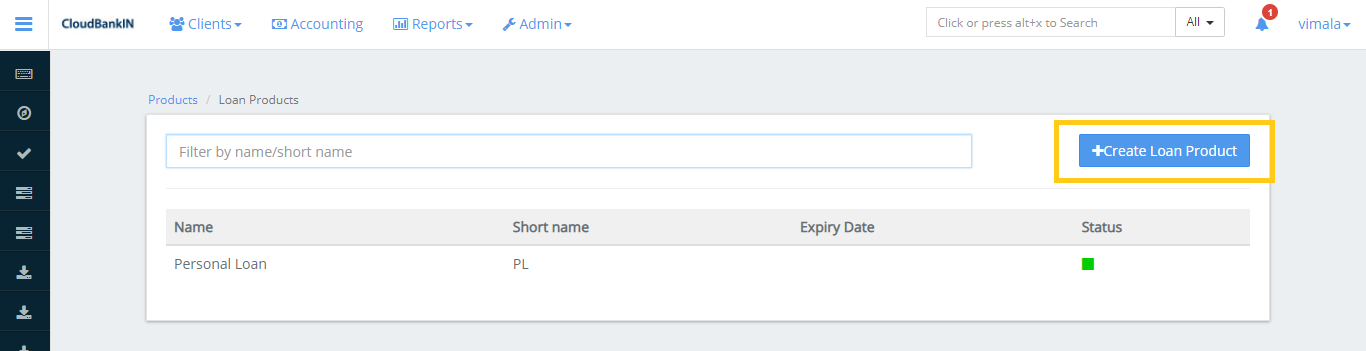

Now the Loan Products form will open, Click on Create Loan Products tab.

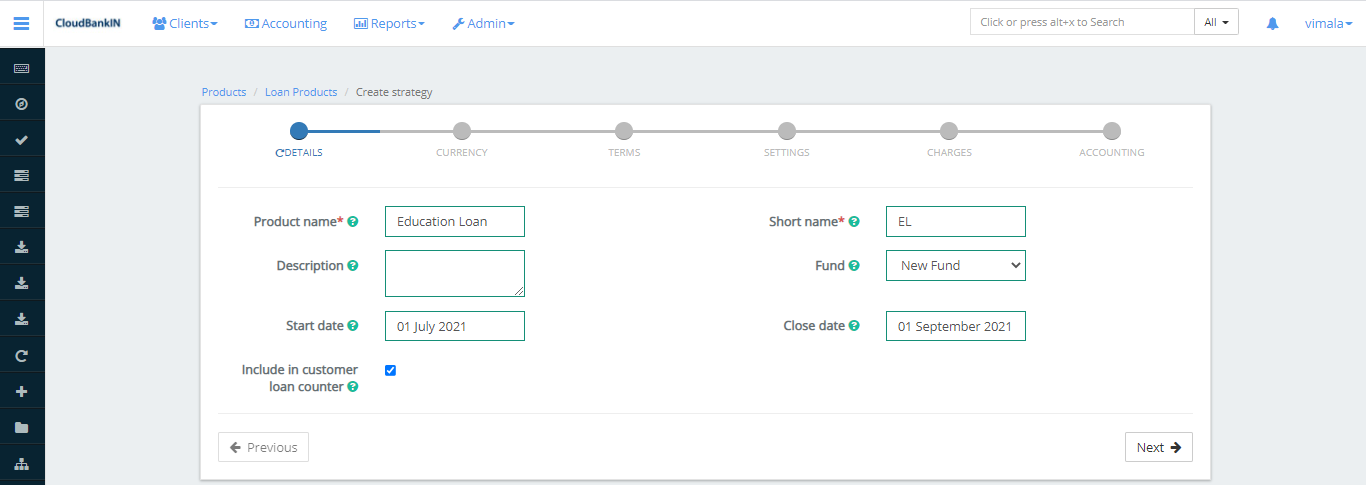

Details

In this form, you have entered the basic details about the Loan Product.

Field Name and Description

- Product Name(*) – Specify your Product Name

- Short Name(*) – Give a Short Name to your Product

- Description – Enter a description of your product

- Fund – If you have a different set of funds for the loan product you can select one of them from the list

- Start Date – Enter the starting date of your Product

- Close Date – Enter the Closing date of your Product

- Include in customer loan counter – If you check this box it will tell us how many times the client has taken this particular product

Update the Mandatory Fields and click Next.

Currency

In the Currency form, you can specify the currency information.

Field Name and Description

- Currency (*) – Select the currency in which the loan will be disbursed. ( You can add your reason in the

Admin ->> System ->> Manage Codes ->> Search for Currency ->> Add Code Values)

- Decimal places (*) – Specify the number of decimal places that should be there in the loan amount

- Currency in multiples of (*) – You can specify the multiples of currency value. For example, if you enter “multiples of 100”, the currency value will be rounded off to 200, 300, 400, etc.

- Installment in multiples of (*) –

Update the Mandatory Fields and click Next.

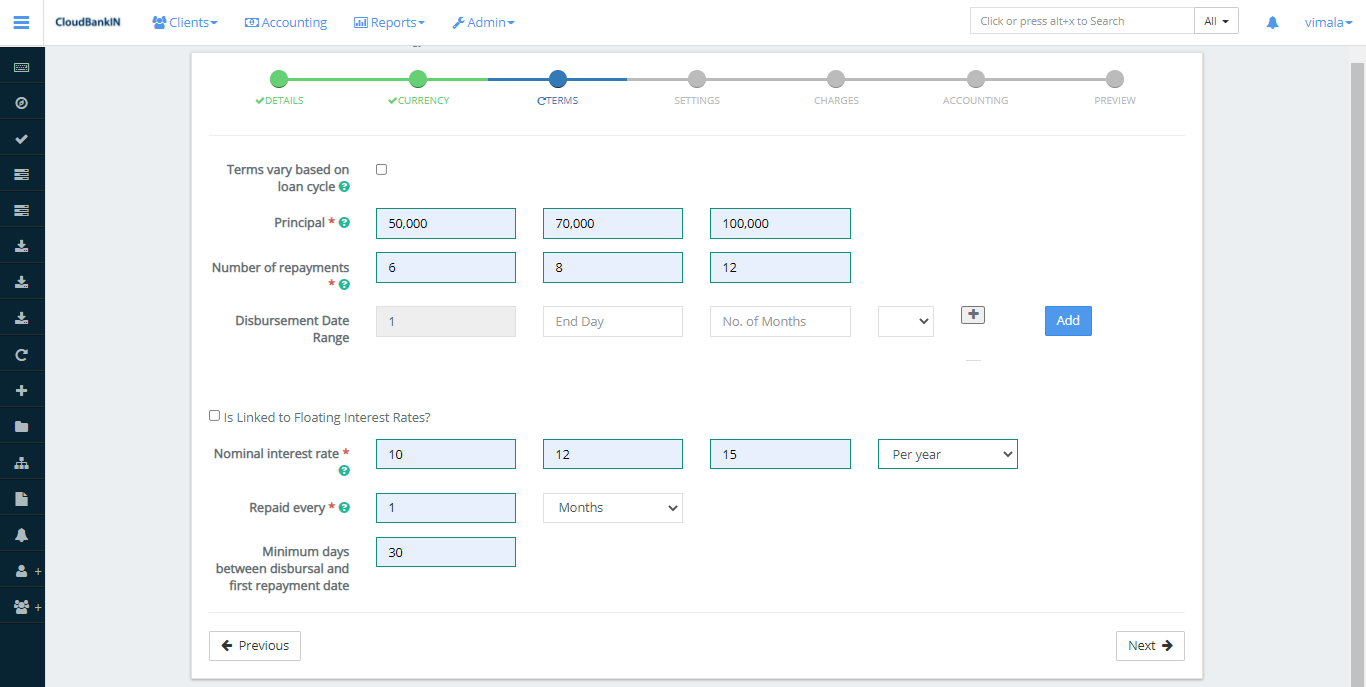

Terms

Field Name and Description

- Terms vary based on loan cycle – A loan cycle keeps track of how many times a borrower has taken a particular loan. If you check this box the terms will change based on the loan cycle.

- Principal (*) – You can specify the minimum, default, and maximum of the amount allowed for this particular loan

- Number of repayments (*) – You can specify the minimum, default, and maximum of repayments allowed for this particular loan

- Disbursement Date Range – Specifies the repayment date range

- Is Linked to Floating Interest Rates?

- Floating interest rate – Specifies the base interest rate on loans (for example, the RBI may raise or lower the interest rate on loans). As a result, banks will maintain a base interest rate for their clients.)

- Is Floating Calculation Allowed – Specifies the floating calculation is allowed or not

- Nominal interest rate (*) – Specifies the minimum, default, maximum period for the nominal interest rate allowed for the loan product. You can select the period value from the drop-down. (ie., Per Month, Per Year, Whole Term)

- Repaid every (*) – Calculate the repayment schedule for a loan account and are used to determine when payments are due. You can select the period value from the drop-down. (ie., Days, Weeks, Months)

- Minimum days between disbursal and first repayment date – You can set the minimum time between the disbursement and the first repayment

- Once the above information’s are updated click on the Next

Settings

Field Name and Description

- Amortization(*) – Refers to the amount of principal and interest paid each month for your loan term

- Equal Installments – Refers the repayment amounts will be equal but the interest, fees, penalties, and principal amounts will vary with each repayment

- Equal Principal Payments – Refers the repayments amounts will vary depending upon the interest, fees, and penalty amounts in the repayment and the principal amount will be the same for all repayments

- Interest method (*) – Refers the Interest payment method you’re going to choose for the repayment of the loan

- Flat – Interest and Principal amount will be the same for all the repayments

- Declining Balance – Specifies the interest rate will be calculated as per the outstanding amount, basically Interest will decrease as the outstanding amount decreases.

- Is Equal Amortization – This loan is repaid in equal installments under this type of repayment

- Interest calculation period (*) – Choose either Daily or Same as Repayment Period

- Daily – Interest will be calculated daily. (eg., February Month has 28 days. So it will calculate for 28 days)

- Same as repayment period – Interest will calculate based on the repayment period (eg, By default it will calculate for 30 days per month)

- Calculate interest for exact days in the partial period – Calculates exact interest for the partial period. (e.g, If the interest rate is calculated starting on July 5th, the interest will be calculated for the partial days of the month, i.e. for 26 days.)

- Repayment strategy (*) – The repayment strategy determines the sequence in which each of the components is paid (i.e, Principal, Interest, Penalties, Fees Order)

- Moratorium – A moratorium period is a period during which the borrower is not required to make any payments on the loan.

- On principal payment – If the Principal Payment is ‘6’ and the client’s Repayment Frequency is every month, the client has to pay only the interest for the first six months, and after six months the client starts paying the principal amount.

- On interest payment – If Interest Payment is ‘6’ and the client’s Repayment Frequency is every month, then the client has to pay only the principal for the first six months and after six months the client starts paying the interest amount.

- Interest free period – If Interest Payment is ‘4’ and the client’s Repayment Frequency is every month, then for the first 4 weeks there will be no interest charged, the client has to pay only the principal and after 4 weeks the client starts paying the interest amount.

- Arrears tolerance – Specifies the maximum amount we can tolerate before moving it to Arrears

- Days in year (*) – Will consider the number of days with respect to the actual calendar or you can choose the number of days in the year from the drop-down

- Days in month (*) – Will consider the number of days with respect to the actual calendar or you can choose the number of days in the month from the drop-down

- Allow fixing of the installment amount – Refers to fix the installment amount manually at the loan account level. (e.g, If the installment amount is 104 and you want it to be 100. By providing 100 manually while creating the loan it will automatically adjust the schedule for all the repayments. Finally, in the last installment, the adjusted amount will be calculated and the same will be reflected in repayment)

- Is Advance EMI – Specifies 1 or 2 EMI amounts will be collected in advance during the disbursement

- Number of days a loan may be overdue before moving into arrears – If the repayment is missed on the scheduled date the next day it will change it as an arrear. Instead, if you specify any specific number in this field, the loan will be moved to arrear once it is exceeded.

- Maximum number of days a loan may be overdue before becoming an NPA (non-performing asset) – If the repayment is missed on the scheduled date the next day it will change it as an NPA (Non-Performing Assets). Instead, if you specify any specific number in this field, the loan will be moved to NPA once it is exceeded.

- Account moves out of NPA only after all arrears have been cleared? (*) – If you select the checkbox it will automatically move out of NPA once the arrear amount is cleared

- Principal Threshold (%) for Last Instalment –If you specified 10% in the last installment, only 10% of interest will be collected in that installment, and the remaining amount will be adjusted in prior installments

- Is Variable Installments Allowed? – These fields are used to define the minimum, maximum gap(days) that should be present between the installments for the loan product. If you select the checkbox it will ask for the value of the variable installment.

- Variable Installments – Specify the minimum and maximum days for the variable installments.

- Is allowed to be used for providing Top Up Loans? – Select the checkbox if this particular loan product is allowed for Top Up Loans

- Enable Flat to Decline Converter – Select the checkbox if this particular loan product enables flat to decline converter

- Is Vehicle Loan – If you check this box, it will ask if you want to include the charges in the Loan Amount calculation.

- Include charges in IRR calculation – Specifies if you want to allow the IRR charges in disbursement.

Interest Recalculation

- Pre-closure interest calculation rule (*)

- Calculate till Pre Closure date – Specifies interest rate will calculate till the pre-closure date (for e.g, if the installment is for 12 months and your pre-closing it in 2 months, the interest will calculate for the 2 months)

-

- Calculate till rest frequency date – Specifies the interest will calculate for the rest of the date (for e.g, for the above scenario, the interest will be calculated for the remaining 10 months)

- Advance payments adjustment type (*) – If the advanced payment is done by the customer for the next installment, then we can either Reduce the EMI amount or Reduce the number of Installments, Otherwise we can reschedule the next repayments

- Interest recalculation compounding on (*) – You can choose any one of the components from the drop-down, based on that the interest will recalculate

-

- None – Next repayment interest will be calculated on Principal

-

- Fee – Next repayment interest will be recalculated based on Principal + Fee

-

- Interest – Next repayment interest will be recalculated on Principal + Interest

-

- Fee and Interest – Next repayment interest will be recalculated based on Principal + Interest + Fee

- Frequency for recalculate Outstanding Principal (*) – You can choose any one of the components from the drop-down. If the client makes advanced repayments, then the outstanding principal will be recalculated based on the mentioned list (i.e, Same as repayment period, Daily, Weekly & Monthly)

- Frequency Interval for recalculation (*) – Specifies the frequency for recalculating the outstanding Principal ( If you enter 1 and select monthly, then the outstanding amount will be calculated for every month)

- Is Arrears recognition based on original schedule (*) – Specifies whether arrears are recognized using the Original Schedule or the Repayment Schedule.

Guarantee Requirements

- Place Guarantee Funds On-Hold?

- Mandatory Guarantee: (%) * –

- Minimum Guarantee from Own Funds: (%) –

- Minimum Guarantee from Guarantor Funds: (%) –

Loan Tranche Details

- Enable Multiple Disbursals

- Enable Multiple Disbursals – If you check this box, it indicates that the loan is a multi-disbursement loan

- Maximum Tranche count – Refers to the maximum number of disbursals allowed for the loan account

- Maximum allowed outstanding balance – Refers to the maximum number of outstanding balances allowed at a point time

Configurable Terms and Settings

If you uncheck, it won’t allow you to edit the values in creating a client.

- Allow overriding select terms and settings in loan accounts

- Amortization – Refers to the amount of principal and interest paid each month for your loan term

- Interest method – Refers the Interest payment method you’re going to choose for the repayment of the loan

- Flat – Interest and Principal amount will be the same for all the repayments

- Declining Balance – Specifies the interest rate will be calculated as per the outstanding amount, basically Interest will decrease as the outstanding amount decreases

- Repayment strategy – The repayment strategy determines the sequence in which each of the components is paid (i.e, Principal, Interest, Penalties, Fees Order)

- Interest calculation period – Choose either Daily or Same as Repayment Period

- Daily – Interest will be calculated on a daily basis. (eg., February Month has 28 days. So it will calculate for 28 days)

- Same as repayment period – Interest will calculate on the basis of the repayment period (eg., By default it will calculate for 30 days per month)

- Arrears tolerance – Specifies the maximum amount we can tolerate before moving it to Arrears

- Repaid every – Specify the duration of the installment. (i.e, Weekly, Bi-Weekly, Monthly)

- Moratorium –A moratorium period is a period when the borrower is not required to make any loan payments

- Number of days a loan may be overdue before moving into arrears – Specifies the maximum number of days we can tolerate before moving it to Arrears

Once the mandatory details are updated click on Next

Charges

- It displays the list of charges that have already been added

- Select the Charges you want to include for this Loan Product from the drop-down menu and click Add

- User can add the new charges from Admin ->> Products ->> Charges ->> +Create Charge

Overdue Charges

- It displays the list of overdue charges that have already been added

- Select the Overdue Charges you want to include for this Loan Product from the drop-down menu and click Add

- The user can add the charges from Admin ->> Products ->> Charges ->> +Create Charge

Accounting

The accounts are grouped into the general ledger categories as listed below. The user can customize the field values as per their requirements in the chart of accounts and map them to the corresponding fields.

Assets

Assets are items that the company owns. It includes loans,securities,reserves, etc.,

- Fund source – An asset account (usually a bank or cash account) that is debited during repayments/payments and credited after disbursal

- Loan portfolio – An asset account that is debited during disbursement and credited when the principal is repaid or written off

- Interest Receivable – An Asset account that is used to collect interest

- Fees Receivable – An Asset account that is used to collect Fees

- Penalties Receivable – An Asset account that is used to collect Penalties

- Transfer in suspense – An Asset account that is used as a suspense account for tracking portfolios of loans under transfer

Income

Income are the items that the company receives including Interest, Penalties, Fees, Repayments, etc.,

- Income from interest – An Income account that is credited during repayment

- Income from fees – An Income account that is credited during fee payment

- Income from penalties – An Income account that is credited during penalty payment

- Income from Recovery Repayments – An Income account that is credited during recovery repayment

Expenses

Expenses are the items that the company spends. It includes salaries and wages, rent, electricity bills, telephone charges etc.,

- Losses written off – An Expense account that is debited on principal write-off. Also debited in the events of interest, fee and penalty written-off in case of accrual based accounting

Liabilities

Liabilities are items that the company owes to someone else, including deposits and bank borrowing from other institutions.

- Liability – A liability account that is credited on overpayments and credited

Advanced accounting rules

The Advanced accounting displays the values that have already been added in Payment Type & Charges. It allows the user to map Payment Types, Fees, and Penalties to the corresponding accounts.

Configure Fund Sources for Payment Channels

Each Payment Channel can have its own Fund Source and you can map it here,

- Payment Type – Select a Payment Type from the Payment Type list (e.g.,Cash, NEFT, etc).

- Fund Source – Each payment type can have a different fund source, you can select the fund source from the drop down

Map Fees to Income Accounts

A different Income Account for each Fee type can be specified.

- Fees – Select a Fees from the fees list (e.g.,Processing Fee, Service Fee, etc).

- Income Account – Each Fees type can have a different income account, you can select the account from the drop down.

Map Penalties to Specific Income Accounts

A different Income Account for each Penalty type can be specified.

- Penalty – Select a Penalty from the penalty list (e.g, Check Bounce Charges)

- Income Account – Each Penalty type can have a different income account, you can select the account from the drop down.

Once mapped the above fields click on the Submit button to create the loan product with Accrual (periodic) Accounting.