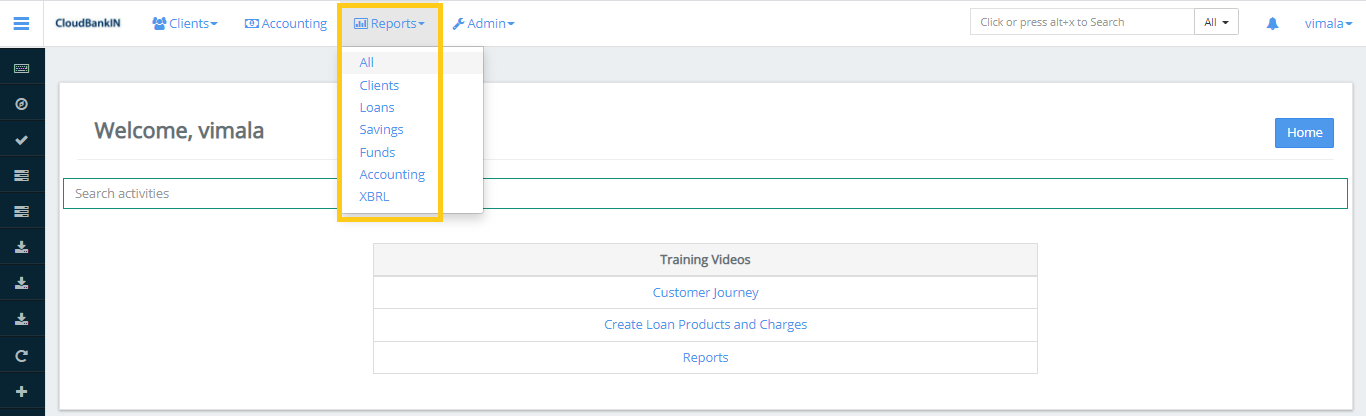

Reports

In this tab, you can see all the Reports related to Loan Accounts, Saving Accounts, Clients, Accounting, Funds, etc.,

The Standard Reports in CloudBankIN are classified into Five categories:

- Clients

- Loans

- Savings

- Funds

- Accounting

Field Name and Description

Standard Reports Field Descriptions

Report Name | Category | Description | Parameters to Search |

| Active Loans – Details | Loan | All active loans are listed, along with details such as principal, interest, and fees outstanding for each Loan. | Office, Loan Purpose, Fund, Currency, Office, Product, Loan Officer, Start Date, End Date |

| Active Loans by Disbursal Period | Loan | Loan principal, interest rate, date disbursed, total loan amount, and total repaid are all listed by disbursal date. | Office, Currency, Fund, Loan Purpose, Loan Officer, Product, Start Date, End Date |

| Active Loans in Last Installment | Loan | List of active loans on their last installment as of the day of the report is generated listing original loan details, expected maturity date as well as principal, penalties outstanding, interest, fees. | Office, Currency, Fund, Loan Purpose, Loan Officer, Product |

| Active Loans in Last Installment (Summary) | Loan | List of active loans on their installment as of day of report, detailed by branch including no of clients, no of active loans and in arrears, total principal, interest, fees, penalties, and PAR calculation for loans on their last installment. | Office, Currency, Fund, Loan Purpose, PAR Calculation, Loan Officer, Product |

| Active Loans Passed Final Maturity | Loan | It displays a list of clients with loan information such as Disbursed Date, Expected Maturity Date, as well as those who have already passed the maturity date. | Office, Currency, Fund, Loan Purpose, Loan Officer, Product |

| Active Loans Passed Final Maturity Summary | Loan | It displays the number of loans with arrears (if any), as well as their details, that have passed their maturity date. | Office, Currency, Fund, Loan Purpose, PAR calculation, Loan Officer, Product |

| Active Loans Summary | Loan | A summary of total clients, active loans, arrears, PAR calculation, total disbursed, principal, interest, fees, and penalties for each branch is based on each branch. | Office, Currency, Fund, Loan Purpose, PAR Calculation, Loan Officer, Product |

| Aging Detail | Loan | Aging Detail gives a list of clients with arrears in terms of the number of ‘Days,’ ‘Weeks,’ and ‘Days in Arrears Band’ under each office. It also shows the original principle, original interest, principal paid, interest paid, principal overdue, and interest overdue for the client. | Office |

| Aging Summary (Arrears in Months) | Loan | Aging summary provides the number of loans in arrears in days (or on Schedule) with the currency type specified under a certain office. | Office, Currency |

| Aging Summary (Arrears in Weeks) | Loan | Aging summary provides the number of loans in arrears in weeks (or on Schedule) with the specified currency type under a certain office. | Office, Currency |

| Balance Sheet | Accounting | It displays a list of GL accounts (Assets, Liabilities, Equities, and so on) as well as the remaining amount in each account at a particular date for a given office. | Office, End Date, Output Type |

| Branch Expected Cash Flow | Loan | This report offers ‘Expected Cash In’ (in terms of Principle, Interest, and Fees Penalty) and ‘Expected Cash Out’ (Loan Disbursals) and ‘Net Expected Cash Out’ at each date for the specified duration. (Expected Cash In ~ Expected Cash Out) | Office, Start Date, End Date, Output type |

| Client Listing | Clients | It displays all clients for a specific branch, along with their Account Number, Client Status, Activation Date, and External Id. | Office |

| Client Loans Listing | Clients | It displays a list of clients and their loan accounts, along with information such as Client Status, Loan Status (Approved, Disbursed, Closed, Rejected, Written-off), Amortization, Loan Frequency, etc. | Office, Currency, Loan Purpose, Fund, Loan Officer, Product, Start Date, End Date |

| Expected Payments By Date – Basic | Loan | It shows Principal/Interest/Fees/Penalties due and Total Due for all clients within a specific office for the given due date of the client. | Office, Loan Officer, Start Date, End Date |

| Funds Disbursed Between Dates Summary | Funds | At a given duration, it lists all the funds which are disbursed with their currency type. | Currency, Fund, Start Date, End Date |

| Funds Disbursed Between Dates Summary by Office | Funds | At a given duration and branch office name, it lists all the funds which are disbursed with their currency type. | Currency, Fund, Office, Start Date, End Date |

| Income Statement | Accounting | This report displays the ‘Balance’ in each income account (ex: Fees Account, Charges Account) as well as the net balance for a specific office and time period. | Office, Start Date, End Date, Output type |

| Loans Awaiting Disbursal | Loan | It displays a list of all the clients and a summary of their loans that are approved but not yet disbursed. | Office, Currency, Loan Purpose, Loan Officer, Fund, Product |

| Loans Awaiting Disbursal Summary by Month | Loan | It displays a list of loan products that are due to be disbursed each month. It also displays the Principal Amount to be Disbursed. | Office, Loan Purpose, Fund, Currency, Loan Officer, Product |

| Loans Pending Approval | Loan | It displays a list of clients and details of their loan accounts which are not yet approved. | Office, Currency, Loan Purpose,Loan Officer, Product |

| Obligation Met Loans Details | Loan | This report displays a list of loans with the details which are paid by the customers without any dues before the maturity date. | Obligation date type, Office, Currency, Fund, Loan Purpose, Loan Officer, Product, Start Date, End Date |

| Obligation Met Loans Summary | Loan | This report displays a number of loans with their details (ex: total principal/interest/fees/penalties repaid) which are paid by the customers without any dues before the maturity date. | Obligation date type, Office, Fund, Currency, Loan Purpose, Loan Officer, Product, Start Date, End Date |

| Portfolio at Risk | Loan | This report shows portfolio at risk (in %) using the formula Portfolio at Risk = Unpaid Principal balance of all loans with payment past due (by age,1,30, 60,90 days Etc) / Outstanding Portfolio. It also shows Interest due, Fees due, Penalties, Fees Outstanding, etc. | Office, Currency, Funds, Loan Purpose, PAR Calculation, Loan Officer, Product |

| Portfolio at Risk by Branch | Loan | This is similar to the previous one but lists portfolios at risk by branch offices. | Office, Currency, Funds, Loan Purpose, PAR Calculation, Loan Officer, Product |

| Rescheduled Loans | Loan | This report displays a list of all rescheduled loans, along with their details (such as the written-off date, the disbursed date, Rescheduled Principal/Interest/Fees, branch-by-branch). | Office, Currency, Product, Start Date, and End Date |

| Trial Balance | Accounting | For a given office, and duration, this report displays a list of GL accounts with their debit and credit records. | Office, Start Date, End Date, Output type |

| TxRunning Balances | Loan | This report displays a list of loan accounts and their transaction type(whether it’s in disbursement state or repayment state) Along with this, it shows Principal, Interest, Outstanding Principal, and Interest Income with specified currency and loan product. | |

| Written-Off Loans | Loan | It displays a list of all the loans which are written off at a given duration. | Office, Currency, Product, Start Date, End Date |

| Credit Bureau Reports | Loan | This report will be useful to submit the data to all four credit bureaus in India. |

The col element

| ISBN | Title | Price | Price |

|---|---|---|---|

| 3476896 | My first HTML | $53 |