Create Loan

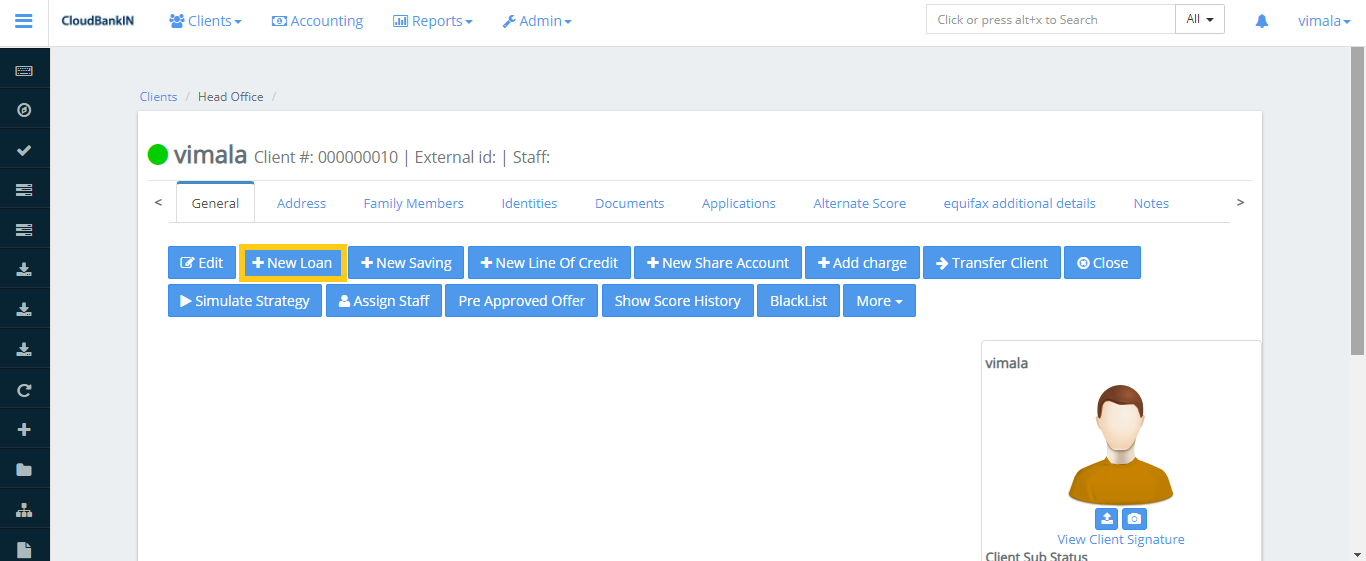

Once the client information has been updated, we can begin with the Loan Application.

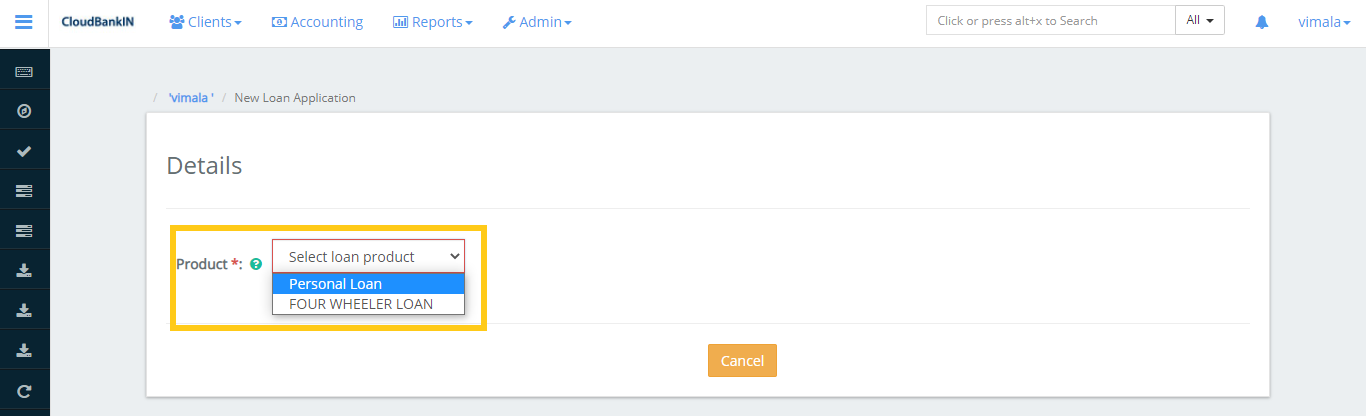

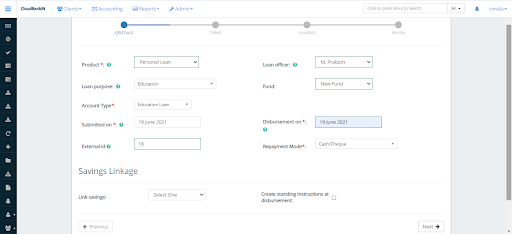

Click on the New Loan and select the Loan Product you are going to offer. In the Loan Product drop-down, it shows the Product Name which already exists. (You can add a Loan Product name in Admin ->> Products ->> Loan Products ->> Create New Product (Refer: Product Creation)) .

Once the Product is created you can see the New Loan Application form.

Update the Mandatory information and click Next.

Field Name and Description

- Product (*) – Select the type of loan your offering

- Loan purpose – Select the purpose for the loan. E.g, ( Education, Vehicle etc.,) (You can add in Admin ->> Manage Codes ->> search Loan Purpose and select ->> click on Add Code Values)

- Account Type (*) – Select the type of loan you’re going to offer and these values are provided by RBI guidelines. (You can add in Admin ->> Manage Codes ->> search Account Type and select ->> click on Add Code Values)

- Submitted on (*) – Choose the date of loan application submission

- External ID – Specify any unique identifier to refer the client in future

- Loan Officer – Choose the Loan Officer name from the drop-down

- Fund – Choose the Fund Name from which you’re going to provide loan

- Disbursement on (*) – Choose the date when the loan is expected to disburse

- Repayment Mode (*) – Choose the Repayment Mode from the drop-down (ie., Cash/Cheque, Nach) (You can add in Admin ->> Manage Codes ->> search RepaymentMode and select ->> click on Add Code Values)

- Link Savings – If your deposit taking nbfc you can link to your loan accounts to the individual customers saving account

- Create standing instruction at disbursement – By selecting this option, the amount will be automatically detected from the client’s account as per the standing instruction specified.

Once you have updated the information in the Details click on Next.

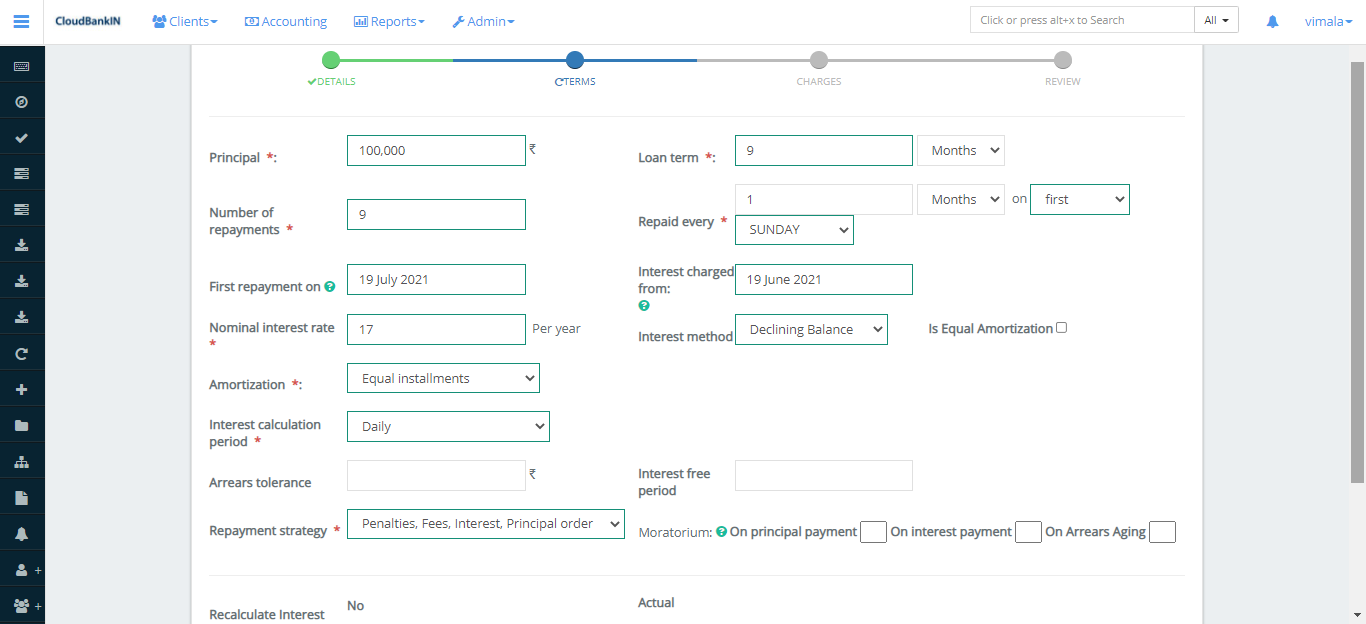

In the Terms form update the mandatory information.

Field Name and Description

- Principal – Specify the amount borrowed from the lender

- Loan Term – Specify the repayment period for the loan amount ( ie, Days, Weekly, Monthly, or yearly)

- Number of repayments – Mention the number of repayments that must be made over the period specified

- Repaid every – Specify the repaid schedule details (ie, Days, Weeks, Months, Years). If you choose Month you can even select the week and day which you want to repay

- First repayment on – You can manually choose the First repayment Date, else the system will automatically assign the date based on the loan submission date

- Interest Charged Form – You can manually choose the Interest Charged Form, else the system will automatically assign the date based on the loan submission

- Nominal interest rate – Specify the interest rate fixed by the lender per year

- Interest Method – Choose whether you want a Flat or Declining Balance for the Interest calculation

- Flat – The interest flat and principal components of all repayments is the same for the life period

- Declining Balance – Specifies the interest rate will be calculated as per the outstanding amount, basically Interest will decrease as the outstanding amount decreases.

- Is Equal Amortization – Specifies the loan repayment will be the same for all the installment. This loan is repaid in equal installments under this type of repayment

- Amortization – Choose either Equal Installments or Equal Principal Payments

- Equal Installments – Specifies the loan repayment amount will be the same for all the installments, but the principal and interest amounts will vary with each repayment

- Equal Principal Payments – Specifies the principal amounts will be equal but the repayment and interest amounts will vary with each repayment

- Interest calculation period – Choose either Daily or Same as Repayment Period

- Daily – Interest will be calculated on a daily basis. (eg., February Month has 28 days. So it will calculate for 28 days)

- Same as repayment period – Interest will calculate on the basis of the repayment period (eg., By default it will calculate for 30 days per month)

- Calculate interest for exact days in a partial period – It calculates the interest for the exact days in the repayment period. For e.g, If I got a Loan on 25th June’21 and my repayment period is 5th July’21. It will calculate the interest for the exact 11 days. And for the next repayment it will be calculated for 31 days.

- Arrears tolerance – Specifies the maximum amount we can tolerate before moving it to Arrears.

- Interest-free period – Specify the interest-free period for the loan amount (ie., If the Interest-Free Period is ‘4’ and the client’s repayment frequency is every week, then for the first four weeks the client need not to pay interest, he has to pay principal due for that week only)

- Repayment strategy – The repayment strategy determines the sequence in which each of the components is paid. Choose any one value from the drop-down to process the repayment.

- Penalties, Fees, Interest, Principal Order

- Overdue/Due Fee/Int/Principal

- Principal, Interest, Penalties, Fees Order

- Interest, Principal, Penalties, Fees Order

If a repayment is to be made, it will be checked in the order listed above. For e.g. I’m taking the third option, If you have a loan with an installment and it is overdue. The instalment amount is 550 dollars (500 Principal, 20 Interest, 15 Penalties, 15 Fees) but you’re paying only 510rs. In this case it will reduce the amount in the specified order (Remaining amount will be 10 Interest, 15 Penalties, 15 Fees)

- Moratorium – A moratorium period is a period during which the borrower is not required to make any payments on the loan.

-

- On principal payment – If the Principal Payment is ‘6’ and the client’s Repayment Frequency is every month, then for the first six months, the client has to pay Interest-only and after six months the client starts paying the principal amount.

-

- On interest payment – If Interest Payment is ‘6’ and the client’s Repayment Frequency is every month, then for the first six months, the client has to pay only the principal and after six months the client starts paying the interest amount.

-

- On Arrears Aging – Number of days a loan maybeoverdue before moving into arrears (ie., If 10 is specified, in arrears aging value, the loan will be in arrears on the 11th day after a scheduled payment is missed.

- Recalculate Interest – If you select the checkbox, system will recalculate the interest based on the outstanding amount for the mentioned period

- Actual – Specifies the interest will calculate for actual calendar days

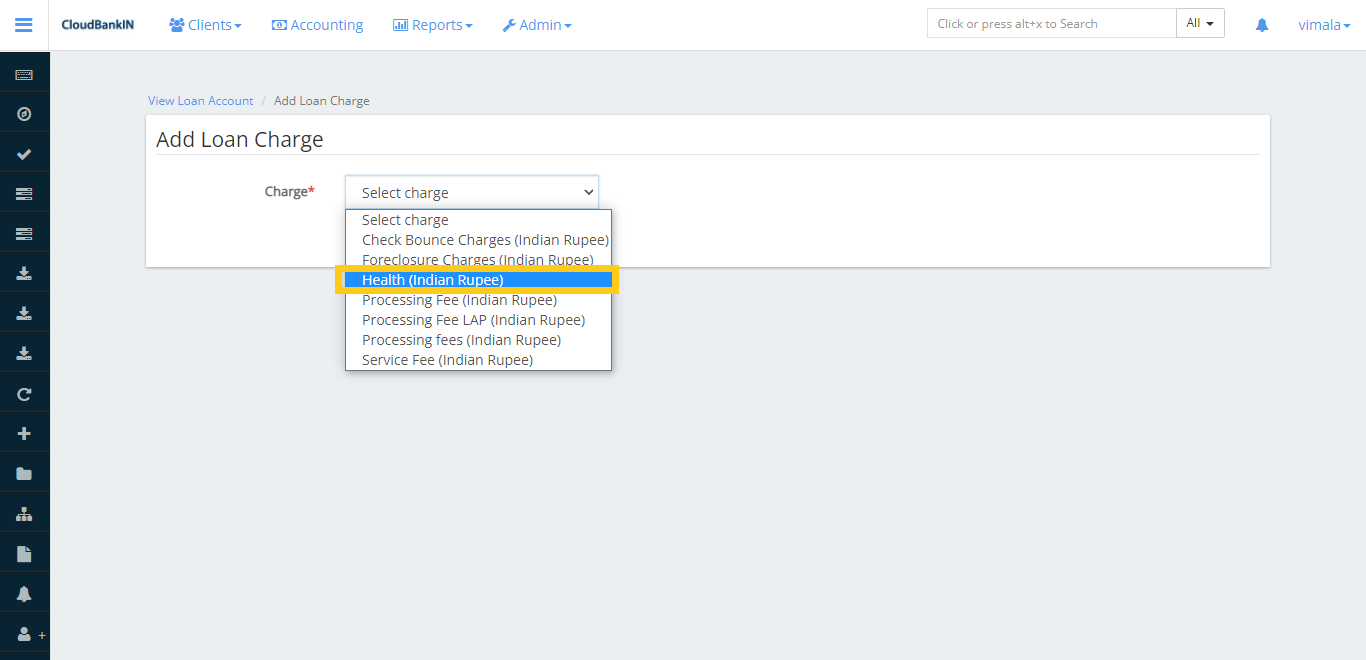

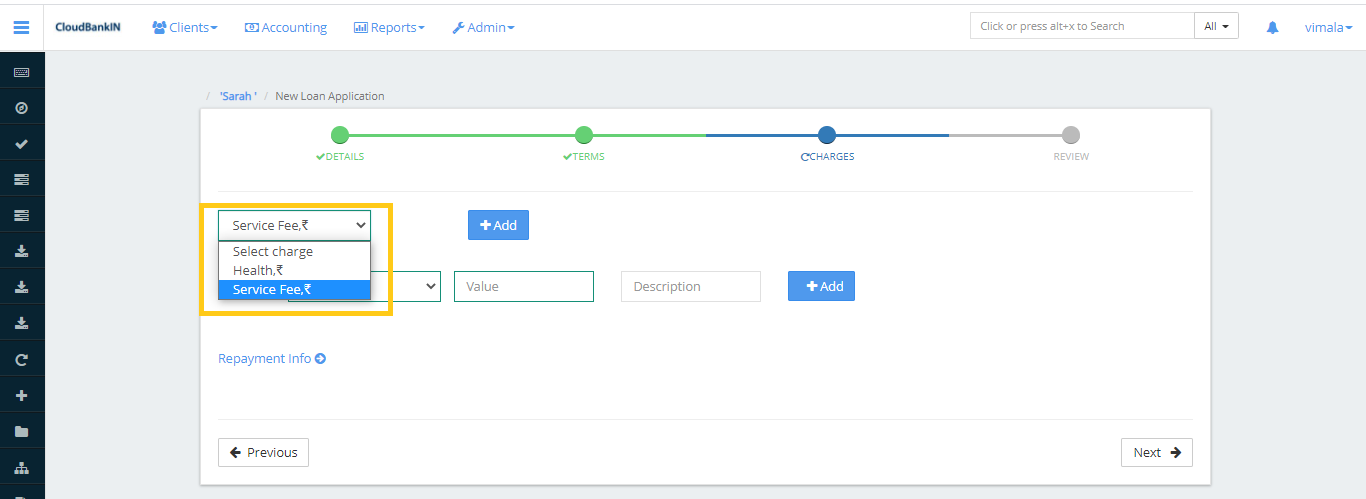

In the charges form select the charge you want to deduct and click on

Next. Click here to know how to

add charges.

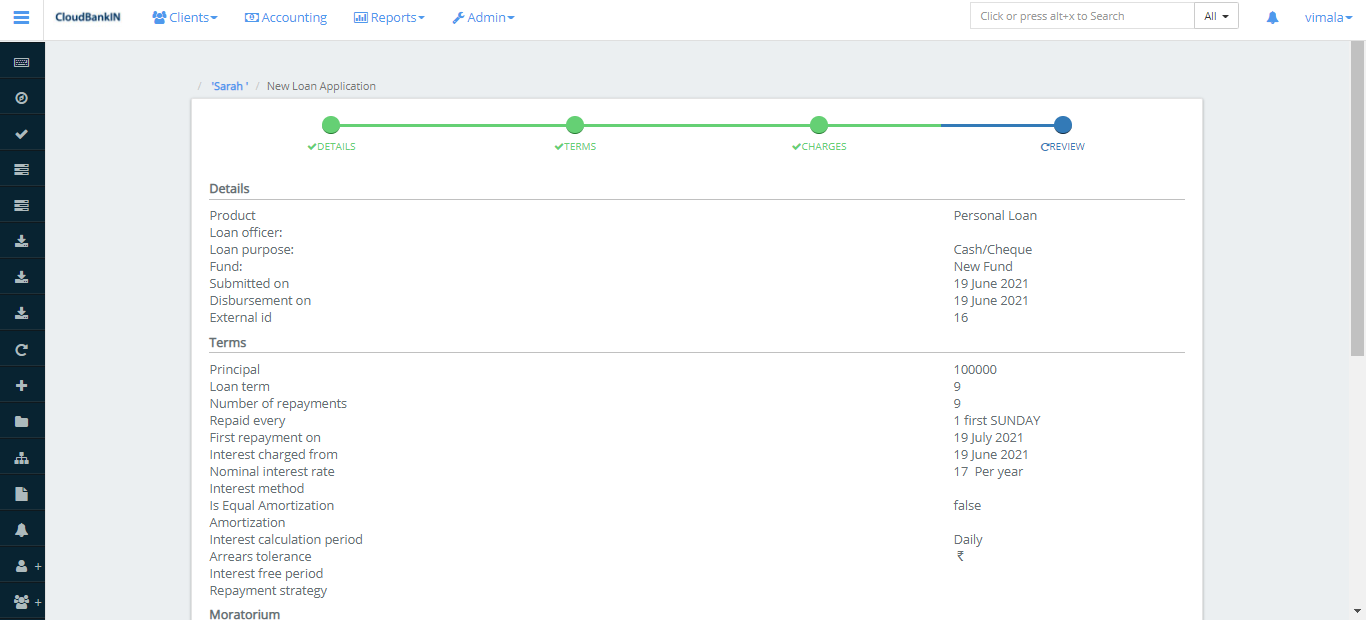

Check the details in the

Review form, then click Submit if everything looks good.

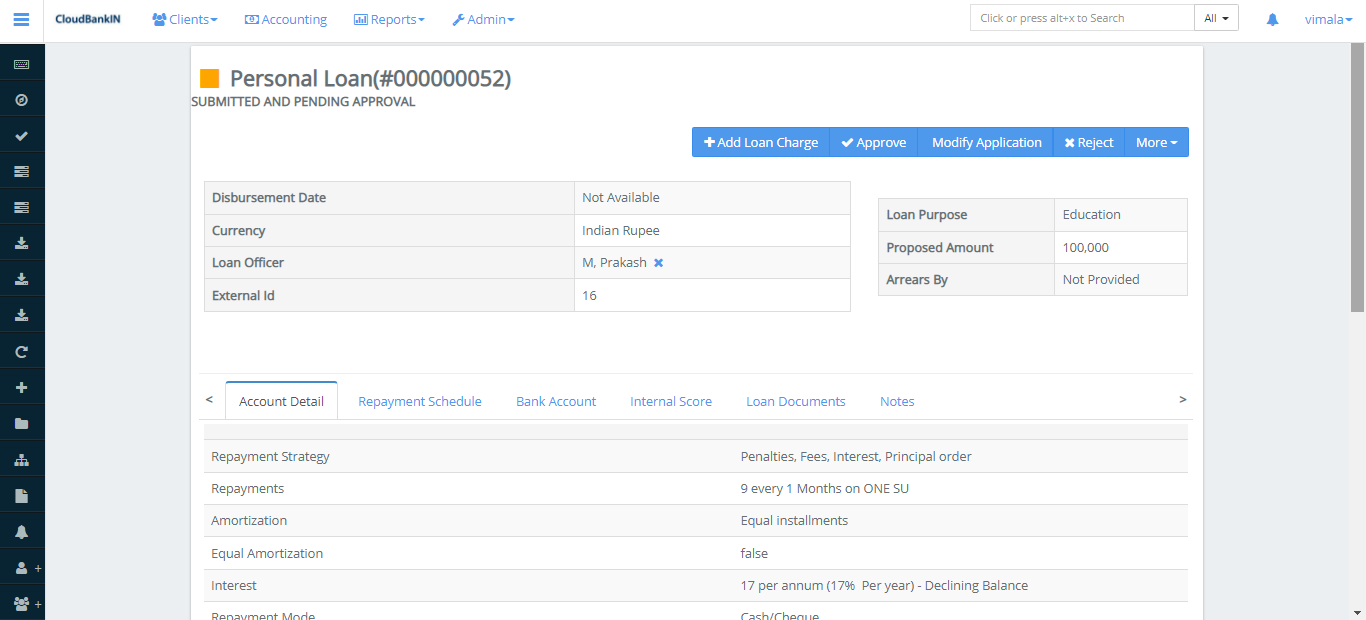

Now the Client’s Loan Account form will be displayed.

Menu Name and Description

- + Add Loan Charge – If you want to change the Charge value you can do it here. Select the Charge from the drop-down and enter the amount you want to add as charge. Charge Calculation & Charge time you can choose it when you’re creating the Charge.